Banco Popolare Croatia d.d. suvremen je univerzalna banka s međunarodnom potporom koja se stalno razvija pružajući klijentima širok spektar proizvoda i usluga. Raspolaga mrežom od 36 poslovnica u Hrvatskoj, zapošljava 300 djelatnika i ima više od 65.000 klijenata uz aktivu od 2,4 milijarde kuna (otkako ju je preuzeo novi vlasnik, povećala se više od 90 posto) i jamstvenim kapitalom od 285 milijuna kuna. Snaga Banco Popolare Croatia je u brzini i fleksibilnosti u pružanju usluga koje nudi i pažnji s kojom njeguje odnos s klijentima. Poslovnice su osvremenjene prema najvišim standardima Grupe Banco Popolare. Ističu se tzv. poslovnim otocima, odnosno pravim savjetodavnim oazama u kojima je zajamčena privatnost klijenta. Banka je orijentirana na poslovanje s građanima te malim i srednjim poduzetništvom, poglavito proizvođačima i izvoznicima. Blisko surađujući s matičnom kućom, uživa u svim prednostima multifunkcionalne i inovativne grupe, kako tehnološkima tako i onima u ponudi proizvoda i usluga. Krediti pravnim osobama porasli su 2010. u odnosu na 2009. za 116 milijuna kuna, odnosno 27 posto, a krediti stanovništvu 16,5 posto. Ukupni su depoziti 31. prosinca 2010. bili 1,84 milijardi kuna, što iznosi 26,4 posto više u odnosu na kraj 2009. Depoziti klijenata u istom su razdoblju rasli 212 posto.

Banco Popolare Croatia d.d. is a modern internationally supported universal bank which is permanently developing and providing its clients with a wide range of products and services. Its network includes 36 branches in Croatia employing 300 people with more than 65,000 clients and an asset structure of HRK 2.4 billion (assets increased by more than 90% since the bank was taken over by a new owner), and a liable capital of HRK 285 million. Its strength lies in speed and flexibility of providing its services as well as in attention it pays to maintaining its relationship with a client. Its branches are modernized in line with the highest standards of Banco Popolare Group. Their so-called ‘Business Islands’ i.e. legal advisory oases which guarantee client’s privacy, are their special feature. The bank is focused on retail, small and medium-sized operations, primarily producers and exporters. Maintaining a close cooperation with its parent company, it enjoys all benefits of a multifunctional and innovative group in terms of technology as well as a product and services range. In 2010 corporate loans increased by 27% i.e. by HRK 116 million,

Page 2

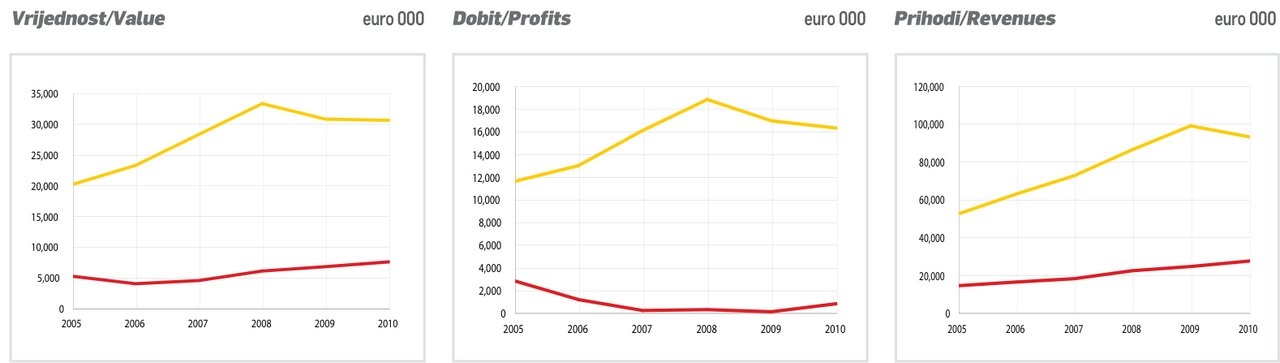

milijuna kuna, odnosno 16,1 posto. Neto kamatni prihod bio je 101,5 milijuna kuna, što je porast od 43,3 posto u odnosu na isto lanjsko razdoblje. Banka je 2010. iskazala dobit od deset milijuna kuna. Surađuje sa svim relevantnim državnim ustanovama i poslovnim udrugama, primjerice Hrvatskom udrugom banaka, Hrvatskom bankom za obnovu i razvitak, Hrvatskom agencijom za malo gospodarstvo, Hrvatskim izvoznicima, Hrvatskim fondom za razvoj i zapošljavanje, Ministarstvom turizma, Hrvatskim poslovnim savjetom za održivi razvoj, Savezom za energetiku Zagreba te Global Compactom. Banco Popolare Croatia surađuje s Cardif osiguranjem i u ponudi ima polici osiguranja koja pokriva rizik od smrti, privremene nesposobnosti za rad ili nezaposlenosti korisnika kredita te služi kao instrument za osiguranje stambenih kredita, kredita za adaptaciju i gotovinskih kredita. Prodaju raznovrsnih polica osiguranja koje banka nudi u suradnji s partnerima – osiguravajućim društvima Basler, Cardif i Generali – u banci smatraju najvažnijim nebankarskim proizvodom u ponudi. Nedavno je tržištu predstavljena paleta zelenih kredita Banco Popolare Croatia namijenjena građanima te malom i srednjem poduzetništvu. Prema istraživanju portala www.croenergo.eu riječ je o najširoj paleti zelenih kredita na hrvatskom tržištu upotpunjenoj EU deskom, dodatnom, besplatnom uslugom za korporativne klijente banke, pomoć poduzetnicima u pronalaženju raspoloživih fondova Europske unije. Zeleni projekt Banco Popolare Croatia upotpunjuju prvi bankarski zeleni ured i prve zelene poslovnice na hrvatskom tržištu kojima je Savez za energetiku Zagreba dodijelio oznaku ‘Green Label’. while the retain loans increased by 16.5% compared to 2009. On 31 December 2010 the total amount of deposits amounted to HRK 1.84 billion i.e. 26.4% more compared to end 2009. In the same period clients’ deposits increased by HRK 212 million or 16.1%. Net interest income was in the amount of HRK 101.5 million, which represents a 43.3% increase compared to the same period the year before. In 2010 the bank recorded profits of HRK 10 million. It cooperates with all relevant government institutions and business associations including the Croatian Banking Association, Croatian Bank for Reconstruction and Development, Croatian Agency for Small Enterprises, Croatian Exporters, Croatian Development and Employment Fund, Ministry of Tourism, Croatian Business Council for Sustainable Development, Energy Union Zagreb and Global Compact. Banco Popolare Croatia cooperates with Cardif Insurance offering the insurance policy covering death, temporary work inability or unemployment of the borrower, and serving as a security instrument for housing, renovation and cash loans. A range of various insurance policies offered in the cooperation with its partners – Basler, Cardif and Generali Insurance Companies – the bank considers its most important non-banking product. The bank has recently launched a range of green loans for retail sector as well as for small and medium-sized entrepreneurs. According to a survey conducted by www.croenergo.eu, this product represents the widest range of green loans on the Croatian market accompanied by the EU Desk, an additional and free-of-charge service for bank’s corporate clients, an entrepreneurial aid in finding available EU funds. The green project of Banco Popolare Croatia is completed by the first green banking office and the first green branches on the Croatian market which were awarded the ‘Green Label’ by the Energy Union Zagreb. \n\n| | 2008. | 2009. | 2010. |\n|———————-|——-|——-|——-|\n| Vrijednost/Value | 5,903 | 6,563 | 7,370 |\n| Prihodi/Revenues | 21,767| 23,928| 26,685|\n| Dobit/Profit | 185 | 0 | 709 |\n| Produktivnost/ | 22 | 22 | 25 |\n| Productivity | | | |\n| Zaposlenih/ | 263 | 292 | 299 |\n| Employees | | | |